Marubozu Candle Pattern In Hindi! Hello Trader bhaiyo aur behno, aaj hum aapko lekar chale hain ek naye safar mein – “Marubozu Candle Pattern” ka safar. Kyunki trading mein jab hum market ki kahani ko samajhte hain, toh ek khaas role ada karte hain candles.

Aur aaj ka humara hero hai “Marubozu.” Is pattern ki kahani sunne ke liye taiyar ho jayein, kyunki hum iss post mein aapko step-by-step guide karenge, samjhayenge ki kyun yeh pattern itna mahatva purna hai, aur sath hi, batayenge kaise aap iska istemal apne trading game ko next level par le jaane mein kar sakte hain. Toh chaliye shuru karte hain, Marubozu ke rangin duniya mein!

| Discover more about DHS authorization on Social Security cards at GovPlus |

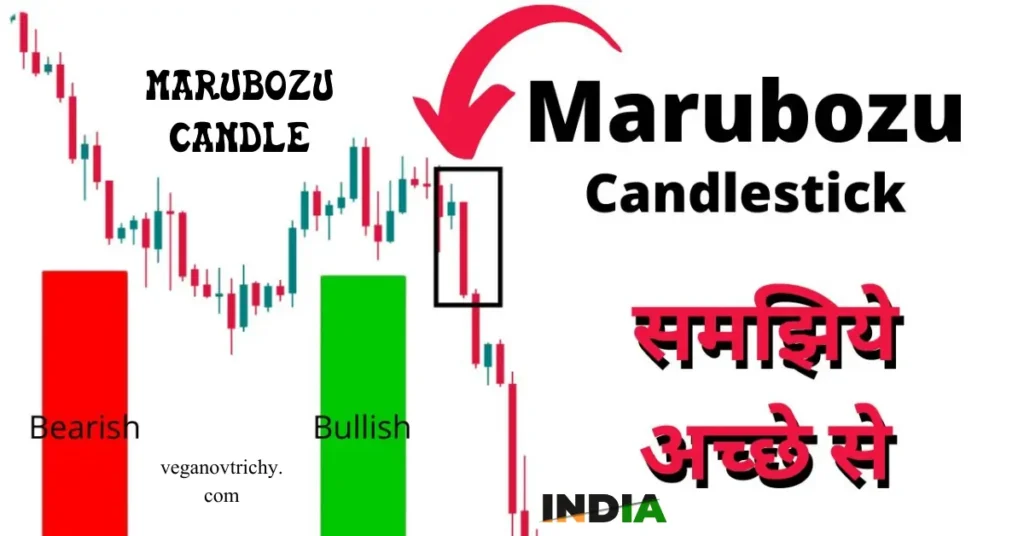

Marubozu Candle Pattern Kya Hai?

Marubozu Candle Pattern ek aisa jaadu hai jo traders ke liye market mein hone wale moves ko samajhne mein madad karta hai. Is pattern ka naam sunte hi kuch sawaal aate honge, jaise “Yeh kaise kaam karta hai?” ya “Iski kya zarurat hai?” Toh chaliye, thoda sa detail mein jaanke samjhein.

Kaise Banta Hai Marubozu:

Marubozu tab banta hai jab ek trading session mein kisi bhi coin ya stock ki opening price aur closing price mein koi bhi farq na ho. Yani ki, ek pura din ke trading ke dauran, jab market khulta hai aur band hota hai, tab dono ke beech mein koi farq nahi hota. Yeh candle ek lamba saaf sa candle hota hai, jismein shadow ya wick ka koi hissa nahi hota.

Iski Kyun Hai Ahmiyat:

Ab aap soch rahe honge, “Is Marubozu mein kya khaas hai?” Iski sabse badi khasiyat hai ki yeh dikhata hai ki market mein ek dum se kaisa mood hai. Agar ek bullish Marubozu hai, toh market neekh aur upar jaa raha hai, aur agar bearish hai toh neeche ki taraf ja raha hai. Is pattern ka istemal karke traders asani se samajh sakte hain ki ab kis direction mein trade karna sahi hoga.

Kyunki Marubozu Hain Trend Ki Kahaani:

Marubozu ek tarah ka trend indicator hai. Iske through hum market sentiment ko samajh sakte hain. Agar ek dum kaafi zor se ek taraf move kar raha hai, toh yeh batata hai ki woh trend strong hai aur traders ko uss direction mein move karna chahiye.

Toh dosto, Marubozu Candle Pattern ek aisa magic wand hai jo traders ko market ke secrets batata hai. Iske bina trading ka game adhoora hai. Ab agla step hai, samajhna ki kaise iska istemal karte hain, jise hum next section mein discuss karenge.

Marubozu Candle Pattern Ka Istemal Kaise Karein:

Marubozu Candle Pattern ka istemal karna asaan hai, lekin sahi tareekay se samajhna aur lagana thoda sa practice aur experience maangta hai. Yahan, main aapko step-by-step guide karunga ki kaise aap Marubozu pattern ka istemal karke apne trading game ko improve kar sakte hain.

Marubozu Ko Identify Karein:

Sabse pehle toh aapko Marubozu candle ko identify karna hoga. Bullish Marubozu mein opening price aur closing price ek jaise hote hain, jabki bearish Marubozu mein bhi yeh dono prices ek doosre ke bohot kareeb hote hain. Isme wick ya shadow ka koi hissa nahi hota.

Confirm Karein Ki Market Trend Mein Hai:

Marubozu ka istemal karne se pehle, zaroori hai ki aap market ke overall trend ko samajh lein. Agar market already uptrend mein hai aur bullish Marubozu aata hai, toh yeh ek aur confirmation hai ki market neeche se upar jaane ka mood mein hai.

Volume Check Karein:

Volume bhi ek important factor hai. Agar Marubozu ke sath acha volume hai, toh yeh aur bhi powerful ho jata hai. High volume ke sath aane wala Marubozu strong trend ko indicate karta hai.

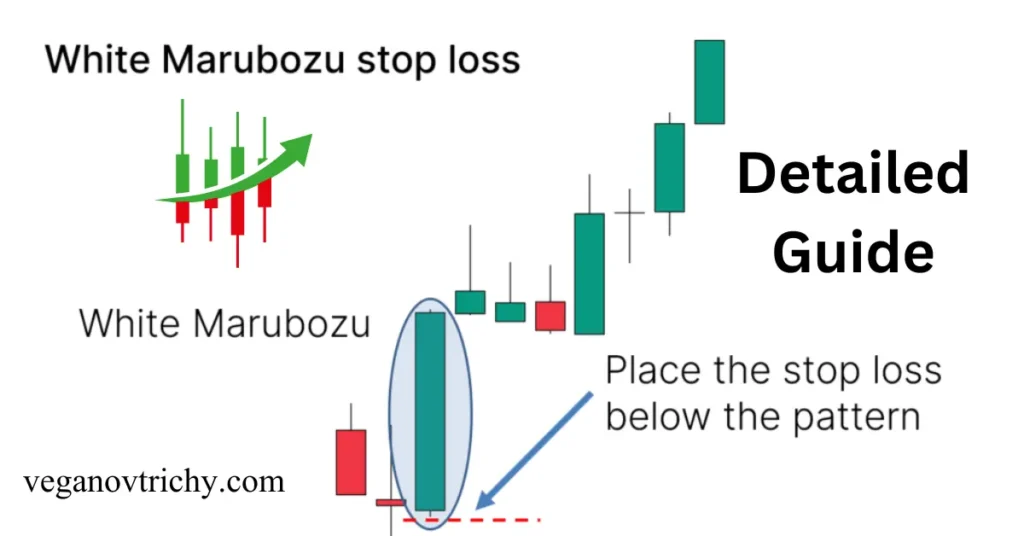

Stop Loss Aur Target Set Karein:

Har trading strategy mein risk management ka bahut bada role hota hai. Marubozu ke trade mein bhi aapko apne liye ek clear stop loss aur target set karna hoga. Isse aap apne trades ko better control mein rakh sakte hain.

Dusre Indicators Ke Saath Combine Karein:

Marubozu ko aur bhi powerful banane ke liye aap ise dusre technical indicators ke saath combine kar sakte hain. Moving averages, RSI, aur MACD jaise tools ka istemal karke aap ek aur layer of confirmation add kar sakte hain.

Practice, Practice, Practice:

Last but not least, practice sabse important hai. Marubozu ko sahi tarah se interpret karna aur iska sahi istemal karne ke liye aapko regular practice karna hoga. Demo trading account ka istemal karke aap apne strategies ko refine kar sakte hain.

Toh yeh the kuch steps jinhe follow karke aap Marubozu Candle Pattern ka sahi istemal kar sakte hain. Yaad rakhein, har market situation alag hoti hai, isliye flexible rehna bhi mahatva purna hai. Happy trading!

You may also like it:

How to Earn Money from E-commerce and Dropshipping – Complete Guide

Online Paise Kaise Kamaye? – Free Me Paise Kamaye [2024] – Veganov Trichy

Advantages of Marubozu Candle Pattern:

| Faida | Wazehat |

| Trend Ka Asaan Pata Chalta Hai: | Market mein hone wale trends ko samajhna Marubozu ke zariye bohot asaan ho jata hai. |

| Strong Market Sentiment: | Bullish ya Bearish Marubozu ke through market ka strong sentiment samajh sakte hain. |

| Clear Entry Aur Exit Points: | Marubozu ki wazehat se aapko clear entry aur exit points milte hain, jisse trading asaan ho jati hai. |

| Volume Ke Saath Aur Powerful: | High volume ke sath aane par Marubozu aur bhi powerful ho jata hai. |

| Short-term Aur Long-term Trading Ke Liye Suitable: | Is pattern ko short-term aur long-term trading mein bhi istemal kiya ja sakta hai. |

Nuksanat (Disadvantages) of Marubozu Candle Pattern:

| Nuksan | Tanbeehat |

| False Signals Ka Khatra: | Kabhi-kabhi Marubozu false signals bhi de sakta hai, isliye isko dusre indicators ke saath combine karna zaroori hai. |

| Choppy Markets Mein Asar Kam Hota Hai: | Agar market choppy hai ya sidha-sada hai, to Marubozu ka asar kam ho sakta hai. |

| Sabhi Market Conditions Mein Nahi Kaam Karta: | Yeh pattern har market condition mein kaam nahi karta, isliye sabhi situations mein is par pura bharosa na karein. |

| Learning Aur Practice Ki Zarurat Hai: | Is pattern ko sahi tarah se samajhne aur istemal karne ke liye learning aur practice ki zarurat hoti hai. |

Upar di gayi table mein aapko Marubozu Candle Pattern ke faiday aur nuksanat dikh rahe hain. Yaad rahe, har trading strategy ki tarah, Marubozu ka bhi istemal samajhdari aur experience ke sath karna chahiye.

Aam Sawalat Marubozu Candle Pattern Ke Baare Mein:

Marubozu Kya Hota Hai?

Marubozu Ka Istemal Kaise Kiya Jata Hai?

Marubozu Kaafi Reliable Hai Ya Nahi?

Kya Marubozu Har Market Situation Mein Kaam Karta Hai?

Marubozu Ke Bina Trading Kiya Ja Sakta Hai?

Umeed hai ki yeh aam sawalat aur unke jawab aapke Marubozu Candle Pattern ke baare mein confusion door karne mein madad karenge.

You may also like it:

How To Increase Followers On Instagram With TakipciGir New Update 2024

1000+ Free Instagram Story Views In 2024 – Veganov Trichy

Conclusion:

Toh, dosto, ab hum pahunch gaye hain iss safar ka ant mein – Marubozu Candle Pattern ke paas. Yeh ek aisa tool hai jo traders ko market ke trends ko samajhne mein madad karta hai. Iska istemal karke aap trends ko pehchan sakte hain, market sentiment ko samajh sakte hain, aur apne trading decisions ko improve kar sakte hain.

Lekin, yaad rahe ki Marubozu ek piece of the puzzle hai – ispar pura bharosa na karein. Market dynamic hoti rehti hai, aur koi bhi indicator 100% perfect nahi hota. Hamesha risk management ko dhyan mein rakhein, aur dusre technical tools aur indicators ke saath combine karein for better results.

Aakhri mein, trading ek art hai jo practice aur patience ka naam hai. Marubozu Candle Pattern ke saath milke, aap apne trading game ko aur bhi strong bana sakte hain. Happy trading!

Bonus Points: Extra Tips Marubozu Candle Pattern Ke Istemal Mein

Multiple Time Frame Analysis:

- Bonus Tip: Agar aap Marubozu pattern ko aur bhi powerful banana chahte hain, toh multiple time frame analysis ka istemal karein. Chhoti aur badi time frames par dekhein ki kya woh confirmations dete hain.

Dusre Indicators Ke Sath Combine Karein:

- Bonus Tip: Marubozu ko aur bhi effective banane ke liye, dusre technical indicators jaise ki Moving Averages, RSI, ya MACD ke saath combine karein. Isse aapko ek aur layer of confirmation mil sakegi.

News Events Ka Dhyan Rakhein:

- Bonus Tip: Kabhi-kabhi major economic events aur news ka asar bhi hota hai. Isliye, trading karne se pehle important news events ka calendar check karein taki unexpected volatility se bacha ja sake.

Educational Resources Ka Istemal Karein:

- Bonus Tip: Market dynamics aur technical analysis ke mazeed samajhne ke liye trading se judi educational resources ka istemal karein. Webinars, courses, aur books aapko aur bhi deep understanding denge.

Demo Trading Mein Practice Karein:

- Bonus Tip: Marubozu pattern ko sahi se samajhne ke liye aur uska istemal karne ke liye, demo trading account ka istemal karein. Isse aap apne strategies ko risk-free environment mein test kar sakte hain.

Toh yeh the kuch bonus points jinhe aap Marubozu Candle Pattern ke istemal mein shamil kar sakte hain. In tips ka istemal karke, aap apne trading skills ko aur bhi refine kar sakte hain. Best of luck!

You May Also like it:

Instagram Par Follower Kaise Badhaye With Can Follow Website – Veganov Trichy

Instagram Par Follower Kaise Badhaye – 2024 Orignal Methode

10+ Very Easy Ways To Make Money With Youtube In 2024 – Complete Guide

How To Make Money Online In 2024 – Complete Guide

![Marubozu Candle Pattern In Hindi [2024] – Detailed Guide marubozu candle pattern In hindi](https://veganovtrichy.com/wp-content/uploads/marubozu-candle-pattern-In-hindi-1024x536.webp)