Bearish Harami Candle In Hindi! Hello dosto! Aaj hum baat karenge ek interesting aur useful candlestick pattern ke baare mein, jise hum Bearish Harami kehte hain. Stock market mein safar kar rahe hain ya bas shauk hai market ki duniya ka, to yeh blog post aapke liye hai.

Bearish Harami Candle ek powerful indicator hai jo traders ko market ke future movements ke baare mein kuch hint deti hai. Is post mein hum is pattern ko samjhege, iski ahmiyat ko explore karenge, aur sikhenge kaise iska istemal humare trading skills ko improve karne mein kiya ja sakta hai.

Toh chaliye shuru karte hain aur Bearish Harami Candle ki duniya mein kuch gehre khayalat explore karte hain!

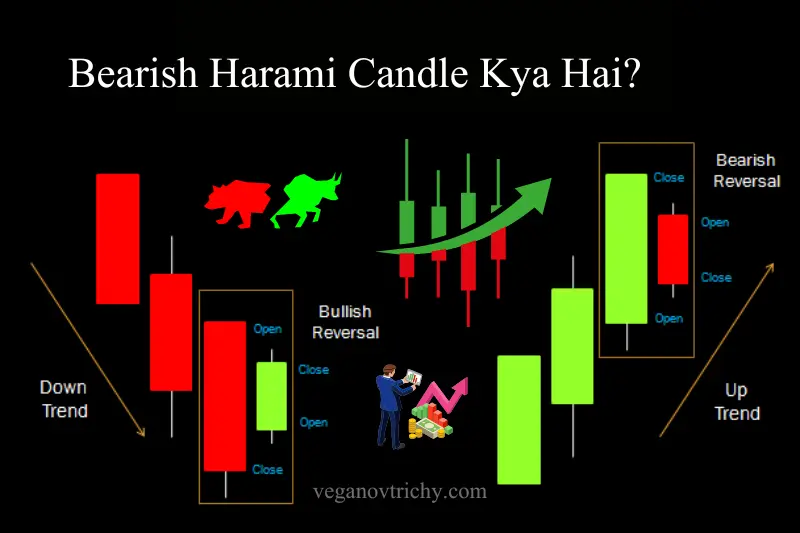

Bearish Harami Candle Kya Hai?

Bearish Harami Candle ek aham candlestick pattern hai jo market analysis mein istemal hota hai. Is pattern ka naam “Bearish” is liye hai kyunki yeh market ki girawat ko darust karti hai. “Harami” ka matlab hai pregnant ya expectant, aur is pattern ki wajah se traders ko lagta hai ki market mein reversal hone ke chances hai.

Iski Ahmiyat Kya Hai?

Yeh candlestick pattern traders ke liye kyun itna important hai? Iski ahmiyat yeh hai ki Bearish Harami market ke mood ka pata lagane mein madad karti hai. Jab yeh pattern dikhai deta hai, toh yeh signal deta hai ki upar ki trend kamzor ho sakti hai aur market mein girawat ane wali hai.

Bearish Harami ka identification karna traders ko early warning deta hai, jisse woh apne trading strategies ko adjust kar sakte hain. Is pattern ki samajh traders ko losses se bachane mein madad karti hai aur unhe market ke movements ko samajhne mein help karta hai.

Toh, agar aap ek naye trader hain ya bas market trends ko samajhna chahte hain, to Bearish Harami Candle ka gahra manana aapke liye faydemand ho sakta hai!

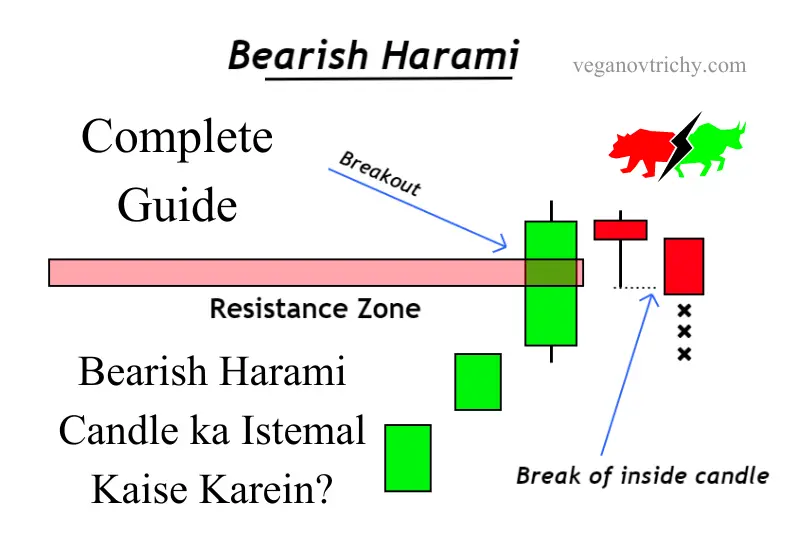

Bearish Harami Candle ka Istemal Kaise Karein?

Bearish Harami Candle ka sahi taur par istemal karna, traders ke liye ek mahatva purna kadam ho sakta hai. Yahan kuch tajaweez di gayi hain jo aapko is pattern ko samajhne aur istemal karne mein madadgar sabit ho sakti hain:

Pehchan (Identification):

Sabse pehle toh, Bearish Harami Candle ko sahi taur par pehchanen. Is pattern ko dhyan se dekhe aur samjhe ki kya do consecutive candles hain, jismein pehla candle bada aur bullish hai, jabki dusra candle chhota aur bearish hai.

Confirmation ke Liye Indicators Ka Istemal:

Bearish Harami Candle ko aur bhi powerful banane ke liye, aap dusre technical indicators ka bhi istemal kar sakte hain. Moving averages, RSI, aur MACD jaise indicators ka istemal karke aap is pattern ki confirmation kar sakte hain.

Risk Management:

Har trading decision ke saath risk management ka dhyan rakhein. Stop-loss orders ka istemal karein taki aap apne nuksan ko control mein rakh sakein. Bearish Harami ke signals par bharosa karte waqt bhi, risk ko kam karne ka dhyan rakhein.

You may also like it:

Marubozu Candle Pattern In Hindi [2024] – Detailed Guide

How To Make Money Online In 2024 – Complete Guide

Hammer Candlestick Pattern In Hindi [2024] – Complete Guide

Time Frame Ka Chayan:

Time frame ka sahi chayan bhi mahatva purna hai. Chhote time frames par Bearish Harami Candle ka signal kam reliable ho sakta hai, isliye longer time frames ka bhi dhyan rakhein.

Market Conditions Ka Visheshagyaan:

Market conditions ko samajhna bhi avashyak hai. Agar overall market trend strong hai, toh Bearish Harami ka signal kam powerful ho sakta hai. Isliye, market ke overall scenario ko bhi consider karein.

Yeh kuch tajaweez hain jo aapko Bearish Harami Candle ka istemal karne mein madad kar sakti hain. Yaad rahe, har trader ka approach alag hota hai, isliye apne risk tolerance aur trading strategy ke hisab se hi is pattern ka istemal karein.

You may also like it:

How to Earn Money from E-commerce and Dropshipping – Complete Guide

Online Paise Kaise Kamaye? – Free Me Paise Kamaye [2024] – Veganov Trichy

Bearish Harami Candle Ka Istemal: Faida aur Nuksan

| Faida (Advantages) | Nuksan (Disadvantages) |

| Market Reversal Ka Pehchan: Bearish Harami Candle, market mein girawat ka early indication deti hai. | False Signals: Kabhi-kabhi yeh pattern galat signals bhi de sakta hai, isliye dhyan se confirm karna important hai. |

| Risk Management Mein Madad: Is pattern ka sahi istemal karke traders apne risk ko control mein rakh sakte hain. | Lagbhag Umar Bhar Ka Pattern Nahin: Yeh pattern thoda short-term hota hai, isliye long-term investors ke liye utna useful nahin ho sakta. |

| Dusre Indicators Ke Saath Compatibility: Bearish Harami ko dusre technical indicators ke saath combine karke aur bhi powerful banaya ja sakta hai. | Market Conditions Par Depend Karta Hai: Agar market strong trend mein hai, to Bearish Harami ka signal kam effective ho sakta hai. |

| Various Time Frames Par Applicable: Is pattern ko alag-alag time frames par istemal kiya ja sakta hai, jisse ki versatile taur par kaam kare. | Learning Curve: Naye traders ke liye, is pattern ko samajhna thoda mushkil ho sakta hai. |

Bearish Harami Candle: Aam Sawalat (FAQs)

Bearish Harami Candle Kya Hai?

Bearish Harami Candle ek technical analysis ka pattern hai jo market mein potential reversal ko darust karne mein madad karta hai. Ismein do consecutive candles hote hain, jismein pehla bada aur bullish hota hai, jabki dusra chhota aur bearish hota hai.

Iska Istemal Kaise Kiya Jata Hai?

Isko samajhne ke liye pehle toh yeh important hai ki aap is pattern ko kaise pehchan sakte hain. Dusre indicators ke saath combine karke, iske signals ko confirm kiya ja sakta hai. Traders is pattern ko risk management aur market trends ko samajhne ke liye istemal karte hain.

Yeh Kitna Reliable Hai?

Bearish Harami Candle ka istemal reliable ho sakta hai, lekin kuch situations mein yeh false signals bhi de sakta hai. Isliye, dusre confirmatory indicators ka istemal karna zaroori hai. Market conditions ko bhi dhyan mein rakhna important hai.

Kya Isko Lagatar Dekhna Chahiye?

Nahin, yeh pattern lagatar dekhne ki zarurat nahin hai. Iska istemal situation par depend karta hai. Agar aap long-term investor hain, toh iske signals ko samajhne ke liye thoda patience rakhna important hai.

Kya Bearish Harami Sirf Stock Market Mein Hota Hai?

Nahin, Bearish Harami Candle not only stock market mein, balki kisi bhi financial market mein istemal kiya ja sakta hai. Forex, commodities, ya cryptocurrency market mein bhi traders is pattern ka istemal karte hain.

Bearish Harami Candle: Aakhri Guzarish

Bearish Harami Candle ek powerful tool hai jo traders ko market movements ke bare mein hint deta hai. Is pattern ka sahi taur par istemal karke, aap apne trading strategies ko improve kar sakte hain aur market ke changes ke advance signals pa sakte hain.

Lekin yaad rahe, har ek trading tool ki tarah, Bearish Harami Candle ka bhi istemal dhyan se aur sahi taur par karna zaroori hai. False signals ka khatra hota hai, isliye dusre indicators ka bhi saath mein istemal karein. Apne risk ko manage karna, market conditions ko samajhna, aur apne trading style ke hisab se is pattern ka istemal karna aapko behtar trading decisions lene mein madad karega.

In conclusion, Bearish Harami Candle ek valuable addition ho sakti hai aapki trading toolkit mein, lekin hamesha dhyan mein rakhein ki market mein koi guarantee nahin hoti. Thoda research aur practice ke saath, aap is pattern ko sahi taur par samajh sakte hain aur apne trading journey mein ek kadam aage badha sakte hain. Happy trading!

You may also like it:

How To Increase Followers On Instagram With TakipciGir New Update 2024

1000+ Free Instagram Story Views In 2024 – Veganov Trichy

Bearish Harami Candle: Bonus Points

Multiple Time Frame Analysis:

- Is pattern ko samajhne ke liye, alag-alag time frames par dhyan dena bhi beneficial ho sakta hai. Chhote aur bade time frames par is pattern ko dekhein, jisse aapko ek comprehensive view mile.

Practice with Demo Accounts:

- Naye traders ke liye, demo accounts ka istemal Bearish Harami Candle aur dusre patterns ko samajhne mein madadgar ho sakta hai. Yeh aapko real market conditions ke bina practice karne ka mauka dega.

Combine with Fundamental Analysis:

- Technical analysis ke saath-saath, fundamental analysis ka bhi istemal karein. Company ke financial health, industry trends, aur economic factors ko consider karke aapko aur bhi strong trading decisions lene mein madad milegi.

Keep Learning and Adapting:

- Market dynamics hamesha badalte rehte hain, isliye apne knowledge ko update karte rahiye. New strategies, tools, aur market trends par nazar rakhein, taki aap apne trading approach ko adapt kar sakein.

Risk-Reward Ratio Ka Dhyan Rakhein:

- Har trade mein risk-reward ratio ka dhyan rakhein. Yani ki, kitna risk liya ja raha hai compared to kitna reward milne wala hai. Yeh approach aapko consistent aur disciplined trading mein madad karega.

Bonus points ko yaad rakhna, aapki trading journey ko aur bhi enrich kar sakte hain. Hamesha seekhte rahiye aur apne skills ko refine karte rahiye, taaki aap market mein confidently aur smartly trade kar sakein. Happy trading!

You May Also like it:

Instagram Par Follower Kaise Badhaye With Can Follow Website – Veganov Trichy

Instagram Par Follower Kaise Badhaye – 2024 Orignal Methode

10+ Very Easy Ways To Make Money With Youtube In 2024 – Complete Guide

![Bearish Harami Candle In Hindi [2024] – Veganov Trichy bearish harami candle in hindi](https://veganovtrichy.com/wp-content/uploads/bearish-harami-candle-in-hindi-1024x536.webp)