The United Arab Emirates (UAE) introduced a federal corporate tax system in 2023, marking a significant milestone in the country’s taxation landscape. Corporate tax applies to business profits exceeding a certain threshold, and compliance is mandatory for all qualifying entities. One of the most critical aspects of this system is understanding the due date for filing a corporate tax return, as missing deadlines can result in penalties and interest charges. This article explains the rules, timelines, and best practices for corporate tax filing in the UAE.

Understanding Corporate Tax in the UAE

Corporate tax in the UAE is levied on the net profits of business entities. The standard rate is 9% for taxable profits above AED 375,000, while profits below this threshold are taxed at 0%. Free zone businesses meeting certain conditions may also benefit from exemptions. The tax system is administered by the Federal Tax Authority (FTA), which provides guidelines on registration, filing, and payment procedures.

Filing a corporate tax return is not just a formality—it is a legal requirement for all companies that meet the taxable income threshold, regardless of whether they owe tax or not. Contact Corporate tax UAE Consultants.

Corporate Tax Return Filing Due Date

According to the UAE Federal Tax Authority, the due date for filing a corporate tax return is nine months after the end of a company’s financial year. Both the tax return and the payment of any tax due must be completed within this period.

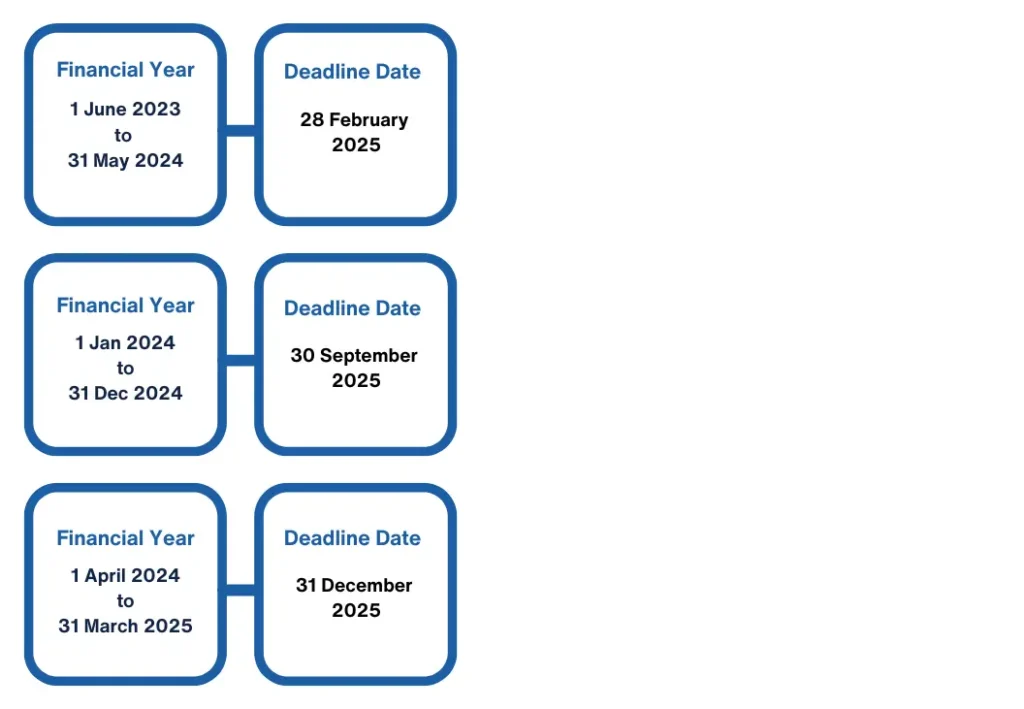

Examples of Filing Deadlines:

- Financial year ending December 31, 2024: The corporate tax return must be filed by September 30, 2025.

- Financial year ending March 31, 2025: The return is due by December 31, 2025.

- Financial year ending May 31, 2024: The due date for filing was February 28, 2025.

This nine-month timeline applies to all businesses, including first-time filers, subsidiaries, and free zone entities that meet the general conditions for taxation.

Special Considerations for First-Time Filers

For companies filing a corporate tax return for the first time, the FTA provides clear guidance:

- Registration Requirement: Businesses must register for corporate tax before the end of their financial year if they expect to meet the taxable profit threshold.

- Nine-Month Filing Window: Even first-time filers must adhere to the standard nine-month deadline.

- Potential Extensions: While some guidance suggests limited extensions for first-time filings, companies are advised to file within the standard period to avoid penalties.

Failing to comply with the due date can lead to late filing penalties starting from AED 1,000, which may increase depending on the duration of delay. Interest on unpaid taxes may also accrue.

Steps to File a Corporate Tax Return in the UAE

Filing a corporate tax return involves several steps, which companies should plan carefully to meet the due date:

- Preparation of Financial Statements: Ensure that your company’s accounts are audited and finalized according to UAE corporate governance standards.

- Tax Calculation: Determine taxable profits after allowable deductions and exemptions.

- FTA Portal Registration: All businesses must have an active FTA account to submit tax returns online.

- Filing the Return: Complete the tax return form accurately, including all income, deductions, and exemptions.

- Payment of Tax: Pay any tax due simultaneously with filing to avoid interest or late fees.

The online FTA portal simplifies the process, providing an interface to submit documents, calculate tax, and make payments securely.

Penalties for Late Filing

Adhering to the corporate tax filing due date is essential because the FTA imposes strict penalties for non-compliance:

- Late Filing: AED 1,000 for delays up to 90 days; AED 2,000 for delays exceeding 90 days.

- Late Payment of Tax: Interest is charged on unpaid tax from the due date until full payment is made.

- Incorrect Filing: Penalties may apply if inaccurate information is provided.

To avoid penalties, companies should maintain organized records, reconcile accounts in advance, and plan for timely submission.

Best Practices for Meeting Filing Deadlines

- Plan Ahead: Start preparing your corporate tax return at least three months before the due date.

- Maintain Accurate Records: Proper bookkeeping simplifies the calculation of taxable income.

- Use Professional Assistance: Tax consultants or certified accountants can ensure compliance and optimize tax positions.

- Monitor FTA Announcements: The FTA may update guidelines, filing forms, or deadlines, and staying informed helps avoid surprises.

- Automate Reminders: Set calendar alerts for the due date and internal checkpoints to ensure all departments complete their inputs.

Conclusion

The due date for filing a corporate tax return in the UAE is nine months after the company’s financial year-end, and this rule applies to all businesses, including first-time filers. Compliance is crucial to avoid penalties, interest, and potential legal issues. By understanding the timelines, preparing financial statements in advance, and using the FTA portal efficiently, businesses can ensure smooth filing and payment processes.

For companies operating in Dubai, Abu Dhabi, or other emirates, awareness of these deadlines and adherence to corporate tax regulations is not only a legal obligation but also a critical element in maintaining financial credibility and operational stability.