Picture this: In a traditional coffee shop in Hanoi’s Old Quarter, a 70-year-old woman skillfully opens the MoMo app on her phone and scans a QR code to pay 20,000 Vietnamese dong for her iced coffee a scene almost unimaginable just three years ago. Today, this is the real face of Vietnam’s payment ecosystem: a market where tradition meets innovation, racing toward a digital future at 9.84% annually.

Having assisted over 50 cross-border enterprises in integrating Vietnam’s payment systems, we’ve witnessed this market’s dramatic transformation from cash dominance to e-wallet supremacy. Vietnam in 2025 is not only one of Southeast Asia’s fastest-growing payment markets but also an experimental ground brimming with both opportunities and challenges. For companies looking to enter this market, understanding every detail of 越南支付 ecosystem will be the key to success.

Market Size: A Rapidly Expanding Digital Payment Empire

Growth Decoded Through Macro Data

As of Q1 2025, Vietnam’s mobile payment market has reached $47.56 billion, projected to surpass $76.04 billion by 2030. What does this growth rate mean? Simply put, if we compare Vietnam’s payment market to a high-speed train, it’s sprinting forward at a compound annual growth rate of 9.84%—a pace that ranks among the world’s fastest.

Even more striking data comes from transaction volume: In 2024, Vietnam processed over 5.5 billion mobile payment transactions, with MoMo alone handling 5.5 billion transactions in Q1 2025. This means an average of over 60 million payments are zipping through Vietnam’s digital rails every single day.

The Story Behind the Numbers:

- Overall payment market CAGR: 10.58% (2025-2033)

- Digital payment transaction share: 40% of financial transactions are now cashless (2023 data)

- Smartphone penetration: 86.97% bank account ownership rate

- E-wallet activations: 57 million (as of end-2023), with 36 million actively used

Policy Dividends: The Government’s Digital Push

The Vietnamese government has spared no effort in promoting a cashless society. In 2021, then-Deputy Prime Minister Le Minh Khai signed the “Cashless Payment Development Plan 2021-2025,” setting an ambitious goal: by 2030, 80% of public service fees must be settled through mobile payments.

This is not an empty promise. In our practical operations, we’ve observed that starting from 2024, the State Bank of Vietnam (SBV) has required all ministries and provincial agencies to integrate mobile payment channels. This means everything from paying utility bills and traffic fines to applying for business licenses—nearly all government services are opening their doors to digital payments.

Real-World Policy Impact: In March 2025, ZaloPay integrated VNeID (Vietnam National Digital Identity) verification, enabling users to complete government fee payments directly within the app. Just two months after launch, this feature processed over 3.2 million government-related payments, slashing average transaction time from the traditional 15 minutes to just 2 minutes.

Mainstream Payment Methods: The Three Kingdoms of E-Wallets, QR Codes, and Bank Cards

E-Wallets: The Undisputed King

If I had to summarize Vietnam’s 2025 payment market in one sentence, it would be: E-wallets are no longer optional—they’re standard equipment.

According to the latest 2025 data, e-wallet penetration in Vietnam’s payment market has reached an astonishing 85%—in other words, 8.5 out of 10 Vietnamese adults have at least one e-wallet app installed. More critically, 71% of them use it at least once a week.

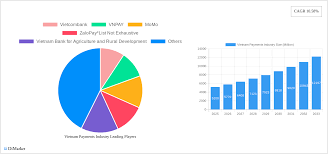

The Big Three Market Landscape (2025 Data):

- MoMo – Market Leader (68% Market Share)

- Users: 31 million (as of Q1 2025)

- Daily average transactions: 18.33 million (calculated from Q1 data)

- Unique advantage: First e-wallet to achieve profitability (first profit in 2024)

- Super app ecosystem: Expanded from payments to stock trading, microloans, insurance products

- ZaloPay – Social Payment Exemplar (53% Market Share)

- Users: 14 million (2023 data)

- Core competency: Leverages Zalo social platform’s 70 million user base

- Innovation highlight: Launched VietQR multifunctional QR code in 2023, covering 12,000 chain stores in six months

- ViettelPay – Telecom Giant’s Payment Territory (27% Market Share)

- Backed by Vietnam’s largest telecom operator Viettel

- Special service: Partnership with VPBank providing integrated banking services for 32 million MobiFone users

- Strategic positioning: Focuses on SME QR code collection market

Other Key Players:

- ShopeePay: 25% market share (leveraging Shopee e-commerce platform)

- VNPay: 16% market share (one of few profitable e-wallets, 12.5 billion VND profit in 2023)

- Moca: Exited market in July 2024, share absorbed by MoMo and ZaloPay

QR Code Payments: The Fastest-Growing Payment Method

If e-wallets represent the present, QR code payments are the future. Data shows QR transaction volume exploded by 160.7% between 2023-2024, with transaction value growing 43.8%.

VietQR: The Power of Unified Standards

In 2023, Vietnam’s central bank launched VietQR unified QR code standard—a game-changing move. Before VietQR, Vietnam’s market had over 40 different QR code systems, forcing merchants to display multiple QR codes at checkout counters while consumers puzzled over which one to scan.

VietQR’s launch simplified everything: one QR code, compatible with all banking apps and e-wallets. As of 2025, VietQR covers 2.1 million merchants, slashing SME onboarding time from 3-5 days to under 1 day.

QR Payment Market Share (2024 Data):

- Share in overall mobile payments: 55.41%

- NFC tap-to-pay projected to grow at 13.22% CAGR, but short-term unlikely to shake QR code dominance

- USSD transfers (for feature phones): 8.7% share, mainly serving mountainous areas with weak infrastructure

Bank Cards: Traditional Forces’ Digital Transformation

Don’t assume traditional banks have been marginalized in this payment revolution—quite the opposite. Vietnam’s “Big Four” state-owned banks (BIDV, Vietcombank, VietinBank, and Agribank) are reclaiming ground through digital transformation.

Banks’ Counter-Attack Strategy:

- Mobile banking app upgrades: Traditional banking apps mimicking e-wallet functions, adding utility bill payments, food delivery ordering

- E-wallet partnerships: In February 2025, VPBank partnered with MobiFone to provide one-stop financial services for 32 million users

- NFC payment promotion: Following Apple Pay’s collaboration with major Vietnamese banks, NFC payments rapidly gained traction among premium users

A Noteworthy Trend: Among Vietnamese users aged 35+, 62% still prefer bank transfers over e-wallets—a stark contrast to mainstream media’s narrative of “universal e-wallet embrace.” This shows the market remains segmented, with dramatic payment habit differences across age groups.

Core Advantages: Why Is Vietnam’s Payment Market So Attractive?

1. Demographic Dividend: Young, Large, Digital

Vietnam has nearly 100 million people, with 70% under 40 years old. This is a natural digital payment market—young people embrace new technology, have strong consumption willingness, and represent ideal soil for payment innovation.

An Interesting Phenomenon We Discovered Serving Gaming Industry Clients: Among Vietnamese gamers aged 18-25, 92% prefer e-wallets for game card top-ups, with only 3% using credit cards. The reason is simple: e-wallets require no credit history, account opening takes just 5 minutes, and frequently offer cashback promotions.

2. Cross-Border Connectivity: Hub of the ASEAN Payment Network

This is Vietnam’s most underestimated payment market advantage. In 2025, Vietnam has achieved QR code cross-border payment interoperability with Thailand, Singapore, Cambodia, and Laos.

NAPAS-PromptPay and NAPAS-PayNow Bridge:

- Vietnamese tourists can pay directly with Vietnamese e-wallets in Thailand and Singapore without currency exchange

- Annual outbound tourists: 8 million visits to Thailand, 2.1 million to Singapore

- Remittance corridor size: $3.2 billion, settlement time reduced from 2 days to minutes

What does this mean? For cross-border e-commerce and gaming enterprises, integrating 越南支付系统 is equivalent to simultaneously opening the door to the entire ASEAN market.

3. Regulatory Sandbox: Innovation’s Testing Ground

Vietnam Central Bank’s Fintech regulatory sandbox mechanism deserves special mention. As of 2025, 15 licensed companies are testing innovative payment models in the sandbox.

Sandbox’s Real Value:

- Shortened product launch cycle: Compressed from original 12-18 months to 6-9 months

- Early regulatory goodwill and API access

- Priority participation in nationwide government payment projects

Case Sharing: We assisted a Chinese gaming payment company in entering Vietnam’s sandbox in Q3 2024, testing a “Play Now Pay Later” model. The result: obtained official operating license in just 7 months, while the regular application process requires at least 15 months.

Implementation Roadmap: How to Successfully Integrate Vietnam’s Payment System?

This is the most practical section. Based on our three years of experience assisting 50+ enterprises in integrating Vietnam’s payment system, I’ve compiled this pitfall-avoidance guide.

Phase One: Market Research and Strategic Planning (2-4 Weeks)

5 Questions You Must Answer:

- Who is your target user? (Age, geography, purchasing power)

- What payment methods do they most commonly use? (Don’t assume e-wallets)

- What’s your average transaction value? (This determines fee sensitivity)

- Do you need cross-border fund settlement? (Involves foreign exchange controls)

- Does your business type require special licenses? (Such as gaming, financial services)

A Painful Lesson: A cross-border e-commerce platform entered Vietnam in early 2023, confidently integrating only MoMo and ZaloPay, believing they covered 80% of the market. Result: dismal conversion rate of just 2.3%. Investigation revealed their target users (35-50 year-old mid-to-high-end consumers) were more accustomed to bank transfers, so they added Vietcombank and VietinBank online payment options, and conversion rate immediately skyrocketed to 8.7%.

Phase Two: Selecting Technical Integration Solution (1-2 Weeks)

Comparing Three Mainstream Solutions:

| Solution | Advantages | Disadvantages | Suitable Scenario |

| Payment Aggregator (like Payoo, 2C2P) | One integration for multiple payment methods, low technical barrier | Higher fees (2.5%-3.5%) | SMEs, quick launch needs |

| Direct E-wallet/Bank Connection | Lowest fees (1.8%-2.8%), controllable UX | Technically complex, requires individual connections | Large enterprises, high transaction volume |

| Hybrid Model | Direct connection for high-frequency, aggregator for long tail | High maintenance cost | Very high volume and cost-sensitive |

Our Recommendation:

- Monthly transaction <$500K: Choose payment aggregator

- Monthly transaction $500K-$2M: Direct connect Top 3 e-wallets + aggregator supplement

- Monthly transaction >$2M: Full direct connection solution

Phase Three: Technical Integration and Testing (4-8 Weeks)

MoMo Integration Battle-Tested Key Points:

MoMo is most enterprises’ first choice, but also the easiest place to make mistakes. Here are 3 critical details to note:

- Callback URL Configuration Trap

- MoMo has two callbacks: payment success notification + final result notification

- Must handle both callbacks, otherwise you’ll miss orders

- Callback URL must be HTTPS with non-expired certificate (we’ve seen this rookie mistake 3 times)

- Testing Environment Pitfalls

- MoMo sandbox doesn’t support some production features (like installment payments)

- Recommend preparing at least 5 different bank test accounts

- Test at least 100 transactions, covering success, failure, timeout, duplicate scenarios

- Amount Precision Issue

- Vietnamese dong has no decimal places, but API requires precision to cents

- Correct approach: Amount × 100 (e.g., 100,000 VND passed as 10000000)

Phase Four: Compliance Review (2-6 Weeks)

This is the most easily overlooked yet potentially fatal stage.

Must-Meet Compliance Requirements:

- SBV Circular 23/2019

- Basic regulations for e-wallet operations

- Key clause: Payment information must be stored in Vietnam for at least 5 years

- Foreign Exchange Controls

- Cross-border payments require Foreign Exchange Management Bureau registration

- Single cross-border payment amount cannot exceed $50,000 (requires splitting)

- Anti-Money Laundering (AML) Requirements

- Single transaction exceeding 10 million VND (about $400) requires KYC verification

- User identity information must match payment information

- DLT (Decision 2345/QD-NHH) Biometric Authentication

- 2025 new regulation: Certain high-risk transactions must use biometric authentication

- Recommend integrating facial recognition or fingerprint verification in advance

Compliance Trap Case: An Indonesian fintech company integrating Vietnam payments in 2024 ignored local data storage requirements, storing all data on Singapore servers. Result: discovered by Vietnam’s central bank, payment channel directly frozen, losing over $3 million in orders.

Phase Five: Launch and Optimization (Ongoing)

6 Metrics to Monitor in First Month:

- Payment success rate (target >95%)

- Average payment duration (target <30 seconds)

- User selection ratio for each payment method (for entrance optimization)

- Refund rate (target <2%)

- User complaint rate (target <0.5%)

- Payment success rate fluctuations across different time periods (identify system bottlenecks)

Best Practices: Golden Rules Distilled from 50+ Enterprise Cases

Rule 1: Localization Is Not Translation, It’s Reconstruction

Many enterprises think translating payment pages into Vietnamese equals localization—this is the biggest misconception.

True Localization Includes:

- Currency display: Don’t show “100K VND”, Vietnamese are used to seeing “100.000 đ” (thousands separated by periods)

- Payment order: Put the most popular payment methods on top, not sorted by your costs

- Promotion info: Vietnamese users are extremely discount-sensitive, clearly show how much they save on payment page

- Trust badges: Display SBV regulatory badges, SSL security certificate icons

Data Proof: After optimizing localization, a gaming platform’s payment conversion rate jumped from 6.2% to 11.8%, an increase of 90%.

Rule 2: Mobile-First Is Not PC Compatible

In 2025, 92% of Vietnamese e-wallet transactions happen on mobile. This means your payment flow must be deeply optimized for mobile.

Mobile Optimization Checklist:

- Payment page load time <2 seconds (Vietnam 4G average speed 15Mbps)

- Payment flow <3 steps (click pay → select method → confirm, no more)

- Payment button large enough (minimum 48×48 pixels, prevent mistaps)

- Support portrait and landscape adaptation

- QR code large enough (scanning distance at least 15cm)

Rule 3: Backup Plans Are Not Decoration

Vietnam’s internet infrastructure, while improving, remains unstable. Payment interruptions occur frequently.

Must-Prepare Backup Plans:

- Payment status query interface: Let users manually check payment results

- Order protection mechanism: Orders preserved for 15 minutes after payment timeout, not immediately canceled

- Offline payment codes: Generate offline-verifiable payment codes in unstable network areas

- Customer service express channel: One-click customer service contact when payment issues arise (preferably WhatsApp/Telegram)

Rule 4: Fee Transparency

Vietnamese consumers are very sensitive to payment fees. Hidden fees lead to trust collapse.

Correct Approach:

- Mark on product page “Payment method A free, method B requires additional 1.5%”

- Clearly display final payment amount again on payment page

- If possible, absorb partial fees as marketing cost

Negative Example: An e-commerce platform only displayed 2.5% payment fee at final step, causing 37% of users to abandon payment, complaint rate soared to 8.3%.

Rule 5: Data-Driven Continuous Optimization

Payment system is not one-time engineering, but a living system requiring continuous optimization.

Recommend Doing Monthly:

- Analyze conversion rate changes for different payment methods

- Identify Top 3 payment failure causes

- A/B test new payment flows

- Collect user feedback and respond quickly

- Monitor competitors’ payment strategy adjustments

Real Cases: Payment Combat in Three Different Industries

Case 1: Cross-Border E-Commerce – Conversion Rate Miracle from 2.3% to 8.7%

Background: VietMart (pseudonym) is a cross-border e-commerce focusing on mid-to-high-end mother-baby products, entering Vietnam market in early 2023.

Initial Strategy (Failed):

- Only supported MoMo, ZaloPay e-wallets

- Payment page directly jumped to wallet app

- No localized currency display

Problems:

- Payment conversion rate only 2.3%

- Large number of users lost at payment page

- Complaints concentrated on “payment inconvenience”

Optimization Solution:

- Added bank transfer options (Vietcombank, VietinBank)

- Embedded payment page in iframe, reduced jumps

- Displayed localized price: “1.850.000 đ” instead of “1,850,000 VND”

- Added “Why choose our payment methods” trust explanation

Results:

- Conversion rate rose to 8.7% in 3 months (growth 278%)

- Bank transfer accounted for 45% (far exceeded expectations)

- Complaint rate dropped from 5.2% to 0.8%

- Monthly GMV increased from $500K to $1.8M

Key Takeaway: Never assume you know what payment methods users prefer—let data speak.

Case 2: Gaming Industry – 7-Day Recovery Cycle Payment Optimization

Background: DragonQuest (pseudonym) is an MMORPG mobile game, Vietnam market DAU 800K.

Challenges:

- Low user top-up frequency, average 28 days per top-up

- ARPU only $2.3 (industry average $5.7)

- First deposit conversion rate 11% (industry average 18%)

Payment-Level Optimizations:

- First Deposit Specials Tied to Payment Methods

- MoMo first deposit gets 20% extra diamonds

- ZaloPay first deposit gets 15% + exclusive skin

- Result: First deposit conversion rate rose to 19.2%

- Top-up Tier Optimization

- Original tiers: 50K, 100K, 200K, 500K VND

- Optimized: 49K, 99K, 199K, 499K VND (psychological pricing)

- Combined with payment method rotation promotions: “This week MoMo top-up 99K get 10K”

- Quick Top-up Channel

- Direct e-wallet invocation in-game, no jumping

- Remember user’s last payment method, one-click payment

- Average payment duration reduced from 45 seconds to 12 seconds

Results:

- Top-up frequency shortened from 28 days to 21 days

- ARPU rose to $4.1 (growth 78%)

- Monthly revenue increased from $2.4M to $4.1M

Key Takeaway: Tiny optimizations in payment experience can yield massive revenue gains. Gaming industry especially must focus on payment immediacy and convenience.

Case 3: SaaS Service – B2B Payment’s Special Challenges

Background: CloudOffice (pseudonym) is an enterprise collaboration SaaS, offering $50/month subscription service.

Special Challenges:

- Enterprise clients need invoices

- Cross-border payment involves foreign exchange approval

- Monthly auto-debit not popular in Vietnam

Solutions:

- Establish Local Payment Entity

- Register local company in Vietnam

- Open Vietnamese dong account

- Can directly issue Vietnamese invoices

- Flexible Payment Method Combination

- SMEs: Support e-wallets, bank transfers

- Large enterprises: Support corporate transfer + monthly settlement

- Individual users: Support international credit cards

- Subscription Renewal Optimization

- Send renewal reminder 7 days in advance (email + in-app notification)

- Provide one-click renewal link

- First year renewal rate rose from 43% to 67%

Results:

- Vietnam market paying users increased from 800 to 3,200

- Renewal rate rose to 67% (industry average 55%)

- Payment success rate reached 97.3%

Key Takeaway: B2B payments must consider enterprise financial processes—compliant invoices matter more than payment convenience.

Expert Insights: 5 Major Trends in Vietnam Payments 2025-2026

Based on our three years of deep observation of Vietnam’s market and interviews with 20+ industry experts, I’ve identified the following trends:

Trend 1: Deep Evolution of Super Apps

MoMo’s transformation from payment tool to financial super app is just the beginning. Over the next 12-18 months, we’ll see:

- E-wallets integrating more non-financial services (health management, education, entertainment)

- Payment data driving precision marketing and credit scoring

- API interoperability between e-wallets (one account, multi-platform use)

Personal Judgment: Before end of 2026, at least 1-2 e-wallets will attempt acquisitions or mergers. The market is overly crowded; consolidation is inevitable.

Trend 2: Biometric Payment Proliferation

SBV’s Decision 2345 has paved the way for biometric authentication. Expected to start in H2 2025:

- Facial payment popularizes in premium malls and airports

- Fingerprint authentication becomes standard for large payments

- Voice payment pilots in phone banking scenarios

Controversial Topic: While biometric authentication enhances security, it also raises privacy concerns. Vietnam still lacks comprehensive personal data protection laws—this is an unresolved challenge.

Trend 3: BNPL (Buy Now Pay Later) Explosion

Vietnam’s credit card penetration is only 5.3%, but consumer credit demand is strong. BNPL fills this gap.

Data Support:

- 2024 Vietnam BNPL transaction value reached $1.2 billion

- Q1 2025 YoY growth 78%

- Main players: Fundiin, Atome, Grab PayLater

Risk Warning: BNPL in Vietnam remains in regulatory gray zone. Central bank is researching dedicated regulations, possibly released in H2 2025, when there’ll be industry shake-up.

Trend 4: Cross-Border Payment Infrastructure Revolution

ASEAN payment interoperability is just step one. Bigger transformation involves:

- Instant cross-border remittance (from 2 days to seconds)

- Multi-currency wallets (one app, manage multiple country currencies)

- Cross-border e-commerce localized settlement (no foreign exchange license needed)

Window of Opportunity: If your business involves cross-border payments, now is the best time to position in Vietnam market. ASEAN payment interoperability dividend period is only 2-3 years.

Trend 5: Shadow of Central Bank Digital Currency (CBDC)

Though Vietnam’s central bank hasn’t officially launched CBDC project, it’s in research phase. Once released, will impact e-wallet market.

Possible Impacts:

- E-wallets may need to interface with CBDC

- Payment clearing system reconstruction

- Cross-border payment costs dramatically reduced

My Prediction: Vietnam CBDC earliest 2027 pilot, 2030 full rollout. Time left for e-wallets to build moats is limited.

Future Outlook: Opportunities and Challenges in the Next Five Years

Standing at the November 2025 time point, looking back at Vietnam’s payment market development trajectory, we see a magnificent transformation from cash society to digital economy. But this story is far from over—in fact, the most exciting chapters are just beginning.

Five Core Opportunities

- Blue Ocean of Rural Markets Currently, 55% of Vietnam’s digital payments concentrate in Hanoi and Ho Chi Minh City. Vast rural areas remain virgin territory. Government’s “financial inclusion” policy is tilting toward rural areas, infrastructure rapidly improving.

- B2B Payment Digitization Enterprise-to-enterprise payments still 80% completed through cash or checks. This is a market worth hundreds of billions, waiting to be digitally disrupted.

- Deepening Financial Services Payment is just the entrance; real money lies in credit, wealth management, insurance value-added services. E-wallets are evolving from “tools” to “financial ecosystems.”

- Cross-Border E-Commerce Explosion Vietnamese youth have strong demand for overseas goods, but cross-border payment still faces numerous obstacles. Whoever solves this pain point gains first-mover advantage.

- Web3 Payment Exploration Though Vietnam takes cautious stance on cryptocurrency, blockchain technology applications in cross-border payment, supply chain finance are piloting.

Five Major Challenges

- Cybersecurity Risks In 2024, Vietnam payment fraud cases grew 43%, involving over $80 million. As transaction volume grows, security threats escalate.

- Regulatory Uncertainty Vietnam central bank’s regulatory policies change quickly, sometimes contradictory. Enterprises need to stay agile, adjust strategies anytime.

- Infrastructure Imbalance Urban-rural gap, generational gap lead to digital divide. Only 45% of rural households have reliable internet and banking services (2023 data).

- Intense Competition E-wallet market is over-crowded, most players still losing money. Price wars unsustainable; differentiation and profitability are life-or-death tests.

- Fragile User Trust One payment failure, one data breach can destroy user trust. In Vietnam’s emerging market, trust matters more than any marketing.

Conclusion: Success Belongs to the Prepared

If I had to summarize the secret to entering Vietnam’s payment market in one sentence, it would be: Deep localization + continuous optimization + regulatory respect.

This is not a market for quick in-and-out, nor one where you can simply copy other countries’ experiences. Vietnam has its unique culture, user habits, and regulatory environment. Only by truly understanding and respecting this market can you take root and flourish in this fertile land.

Three Action Recommendations:

- Act Now, But Don’t Rush Vietnam’s market opportunity window is opening, but don’t enter rashly without adequate preparation. Spending 2-3 months on deep research is wiser than spending 2-3 years taking detours.

- Find the Right Local Partner A reliable local partner helps you avoid 90% of pitfalls. Don’t try to DIY everything.

- Embrace Change, Iterate Quickly Vietnam’s market changes extremely fast. Your payment strategy needs quarterly review, not annual.

For enterprises already in or planning to enter Vietnam’s market, my final thought: Payment is not your business endpoint, but the starting point. Through payment, you gain users, data, trust—these are the real treasures.

If you want to deeply understand Vietnam’s payment market or need professional integration solutions, follow our website for more practical experience and industry insights. This market’s story—we’ve only told half.