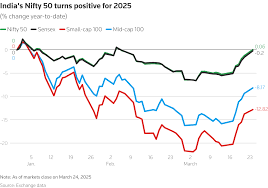

The Nifty 50 index is a crucial benchmark for the Indian stock market, encompassing the 50 largest companies across various sectors. In H1-2025, the performance of these stocks continues to reflect India’s economic resilience, with certain key stocks driving the momentum. Among the standout performers, Bharat Electronics Limited (BEL) and Reliance Industries have captured significant investor attention. By evaluating their individual performances and broader market trends, it becomes clear why they are essential components of a well-rounded investment strategy.

BEL Share Price: A High-Flying Performer

Bharat Electronics (BEL) has demonstrated impressive growth, becoming a strong contender in the Indian stock market. As one of the leading players in the defence and aerospace sector, BEL’s expertise in manufacturing cutting-edge defence systems has made it a long-term favourite for investors. The BEL share price has soared by 1387.07% over the past five years, reflecting both the expanding market for defence products and the company’s increasing dominance in this niche.

In H1-2025, the stock has remained resilient, with its 52-week range spanning ₹240.25 to ₹407.50. This robust performance can be attributed to the company’s strategic contracts with the Indian Defence and its expanding non-defence sector. Bharat Electronics is optimistic about expanding its footprint in both domestic and international markets, aiming to capitalize on the increasing demand for advanced defence systems.

In addition to its defensive strength, the company’s focus on diversification has allowed it to tap into civilian sectors, such as cyber security and e-mobility. This forward-thinking approach promises continued growth, making BEL a strong contender for investors seeking stability and high returns in the long run.

Reliance Share Price: A Titan in the Indian Market

Reliance Industries, a giant in India’s corporate landscape, continues to dominate the market with its diverse portfolio. As a conglomerate with interests in sectors ranging from petrochemicals and energy to telecommunications and retail, Reliance share price has remained a bellwether stock for market performance. Throughout H1-2025, Reliance has shown remarkable consistency, with its 52-week range spanning ₹1,114.85 to ₹1,608.80.

The company’s market cap of ₹19,34,940.07 Cr reflects its enormous scale and influence across multiple industries. Reliance’s substantial investments in digital and retail sectors, notably through Jio Platforms and Reliance Retail, continue to position it as a market leader. Its diversified approach helps it weather economic downturns while capitalizing on growth opportunities in India’s rapidly evolving digital landscape.

Reliance’s ongoing efforts in clean energy and new materials further solidify its standing as a future-forward company. Investors are drawn to the company’s strategic acquisitions and ventures in new energy, which promise long-term growth, particularly as the world moves towards more sustainable solutions.

Key Sector Trends Influencing Nifty 50 Stocks

Resilience in the Energy Sector

Energy stocks like Reliance have shown steady performance in H1-2025, thanks to their diversified operations and investments in renewable energy. Companies focusing on energy transition and sustainability, such as Reliance, are well-positioned to capitalize on government incentives and the global shift towards green energy.

Defence Sector Growth

The defence sector, represented by BEL, continues to benefit from both domestic and international defence contracts. With the Indian government increasing its defence spending and focusing on modernizing its armed forces, BEL stands to gain substantially. As countries worldwide ramp up their military readiness, defence-related companies are experiencing significant growth.

Conclusion: Nifty 50’s Leading Performers in 2025

In H1-2025, the Nifty 50 index has shown robust performance, with Reliance Industries and Bharat Electronics standing out as top performers. BEL’s impressive growth in the defence and civilian sectors, combined with Reliance’s dominance across multiple industries, makes them both prime candidates for investors seeking stability and long-term growth.

For those looking to diversify their portfolios, these companies offer promising returns, driven by their market-leading positions and forward-thinking strategies. As India’s economy continues to expand, the Nifty 50 stocks will likely remain at the heart of investors’ strategies, offering a mix of growth and stability. Whether you’re looking to capitalize on the booming digital landscape or tap into the growing defence sector, these stocks should be part of any long-term investment plan.